Investors can calculate it easily if they have the balance sheet of a company of interest. Investors can compare BVPS to a stock’s market price to get an idea of whether that stock is overvalued or undervalued. A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase. The price per book value is a way of measuring the value offered by a firm’s shares.

Market Value Limitations

At its core, it’s subtracting a company’s preferred stock from shareholder equity and dividing that sum by the average amount of outstanding shares. Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value how to import a chart of accounts into xero of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible assets relative to their intellectual property and human capital (labor force). These intangibles would not always be factored in to a book value calculation.

Book Value vs. Market Value: What’s the Difference?

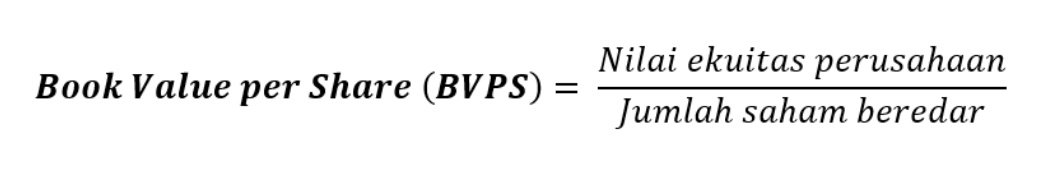

The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding. Yes, if a company’s liabilities exceed its assets, the BVPS can be negative, signaling potential financial distress. Value investors use BVPS to identify stocks that are trading below their intrinsic value, indicating potential undervaluation. While Book Value Per Share can be a helpful indicator of a company’s tangible net assets, it has several limitations that investors should be aware of.

Is Book Value a Good Indicator of a Company’s Value?

- The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding.

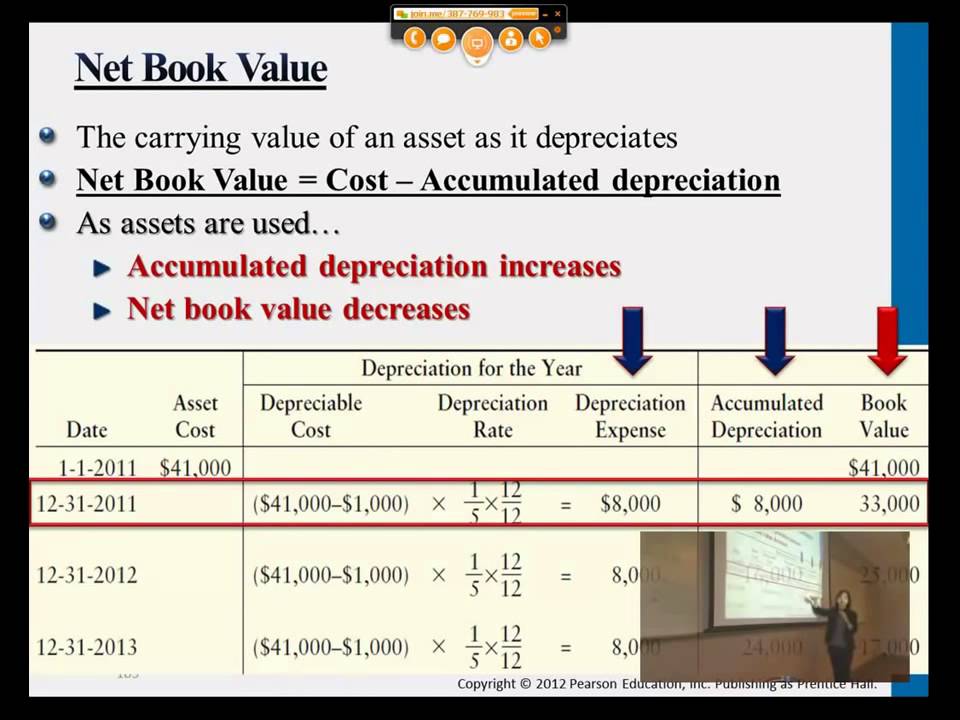

- If assets are being depreciated slower than the drop in market value, then the book value will be above the true value, creating a value trap for investors who only glance at the P/B ratio.

- On the other hand, value investors might look for a company where the market value is less than its book value hoping that the market is wrong in its valuation.

- Using the same share basis formula, we can calculate the book value per share of Company B.

- They typically raise equity capital by listing the shares on the stock exchange through an initial public offering (IPO).

If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. BVPS relies on the historical costs of assets rather than their current market values. This approach can lead to significant discrepancies between the book value and the actual market value of a company’s assets. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

How to Calculate BVPS?

Value investors actively seek out companies with their market values below their book valuations. They see it as a sign of undervaluation and hope market perceptions turn out to be incorrect. In this scenario, the market is giving investors an opportunity to buy a company for less than its stated net worth. Long-term investors also need to be wary of the occasional manias and panics that impact market values. Market values shot high above book valuations and common sense during the 1920s and the dotcom bubble. Market values for many companies actually fell below their book valuations following the stock market crash of 1929 and during the inflation of the 1970s.

Most publicly listed companies fulfill their capital needs through a combination of debt and equity. Companies get debt by taking loans from banks and other financial institutions or by floating interest-paying corporate bonds. They typically raise equity capital by listing the shares on the stock exchange through an initial public offering (IPO). Sometimes, companies get equity capital through other measures, such as follow-on issues, rights issues, and additional share sales. It is unusual for a company to trade at a market value that is lower than its book valuation. When that happens, it usually indicates that the market has momentarily lost confidence in the company.

Among these, the book value and the price-to-book ratio (P/B ratio) are staples for value investors. The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS. If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. Book value per share is a way to measure the net asset value that investors get when they buy a share of stock. Investors can calculate book value per share by dividing the company’s book value by its number of shares outstanding. The book value of a company is equal to its total assets minus its total liabilities.

Finding those bargains can be challenging because stocks that are obviously underpriced tend to self-correct quickly. Still, there are a few tactics that can help you discover value-rich investments for your portfolio. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.