For employees and business owners alike, managing overtime and bonus pay can be a challenge. Workers rely on accurate and timely payments, while employers must ensure payroll calculations are correct to avoid compliance issues. A paycheck creator simplifies this process by automating payroll calculations, reducing errors, and ensuring transparency.

In this blog, we’ll explore how a paycheck creator can help manage overtime and bonus pay efficiently. Whether you’re an employee tracking extra earnings or an employer handling payroll, this tool can make financial management easier and more reliable.

Understanding Overtime and Bonus Pay

Overtime Pay

Overtime pay refers to the additional compensation employees receive for working beyond their regular hours. In the U.S., the Fair Labor Standards Act (FLSA) mandates that non-exempt employees receive 1.5 times their regular pay rate for hours worked over 40 hours per week.

Common overtime scenarios include:

- Working extra shifts

- Holiday or weekend work

- Emergency coverage needs

Bonus Pay

Bonus pay is an additional amount given to employees as a reward or incentive. It can be performance-based, seasonal, or company-wide. Common types of bonuses include:

- Performance bonuses for exceeding targets

- Holiday bonuses as an end-of-year reward

- Retention bonuses to retain valuable employees

Challenges in Managing Overtime and Bonuses

Many businesses and employees struggle with accurately tracking overtime and bonus pay. Challenges include:

- Miscalculations: Errors in pay rate calculations can lead to underpayment or overpayment.

- Lack of proper documentation: Without accurate records, disputes can arise between employees and employers.

- Complex tax deductions: Overtime and bonus pay are subject to different tax rules, which can be difficult to manage manually.

Using a paycheck creator helps resolve these issues by automating calculations and ensuring compliance with labor laws.

How a Paycheck Creator Helps with Overtime and Bonus Pay

1. Automates Payroll Calculations

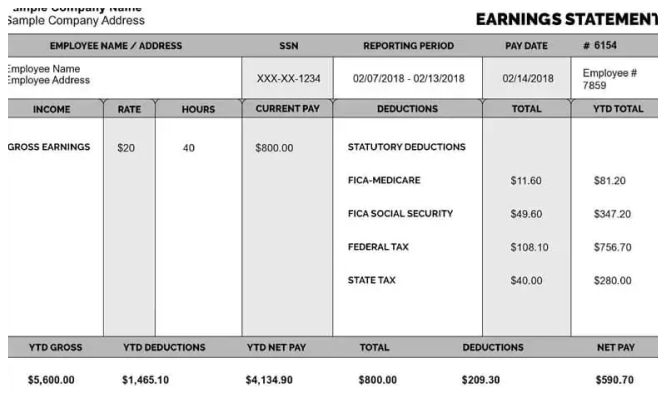

A paycheck creator automatically calculates overtime rates and bonuses, ensuring accuracy in payroll processing. Users simply enter the number of hours worked and any applicable bonuses, and the tool generates a detailed pay stub.

2. Ensures Compliance with Labor Laws

A reliable paycheck creator follows labor laws and overtime regulations, reducing the risk of payroll violations. It applies correct tax rates and deductions, ensuring compliance with federal and state laws.

3. Provides Clear and Transparent Records

Employees can use paycheck creators to track their earnings, while employers maintain organized payroll records. This transparency reduces disputes and enhances trust in the workplace.

4. Helps with Tax Reporting

Overtime and bonus pay are subject to taxes, including federal income tax, Social Security, and Medicare. A paycheck creator automatically calculates and includes these deductions, making tax reporting easier for both employees and employers.

5. Simplifies Payroll for Small Businesses

For small business owners without dedicated payroll departments, a paycheck creator simplifies the process by handling calculations, tax deductions, and pay stub generation. This reduces administrative workload and ensures employees are paid accurately and on time.

Step-by-Step Guide to Using a Paycheck Creator for Overtime and Bonus Pay

Step 1: Choose a Reliable Paycheck Creator

Select a paycheck creator that offers automated overtime and bonus calculations, accurate tax deductions, and easy pay stub generation.

Step 2: Enter Employee Details

Include employee names, job titles, and payment structures. For freelancers or self-employed individuals, input client payment details.

Step 3: Input Overtime Hours and Rates

Enter the number of overtime hours worked and the applicable pay rate (usually 1.5 times the regular pay rate for hours beyond 40 per week).

Step 4: Add Bonus Pay

Include any additional earnings, such as performance or holiday bonuses, ensuring they are clearly documented.

Step 5: Generate and Review the Pay Stub

Once all details are entered, generate the pay stub. Review the calculations for accuracy, ensuring overtime and bonus pay are correctly applied.

Step 6: Save and Share the Pay Stub

Download and save the pay stub for record-keeping. Employers can provide a digital or printed copy to employees, ensuring transparency in payroll processing.

Choosing the Best Paycheck Creator for Your Needs

When selecting a paycheck creator, consider the following factors:

- Ease of Use: A user-friendly interface ensures quick and easy payroll calculations.

- Accuracy: The tool should automatically calculate overtime, bonuses, and tax deductions correctly.

- Customization: The ability to adjust pay structures and add additional income types is beneficial.

- Security: Since payroll involves sensitive financial data, choose a secure tool that protects personal information.

Conclusion

A paycheck creator is an essential tool for managing overtime and bonus pay. It ensures accurate payroll calculations, maintains compliance with labor laws, and simplifies tax reporting. Whether you’re a business owner handling payroll or an employee tracking earnings, using a paycheck creator streamlines the process, reducing errors and ensuring financial accuracy.

For businesses and freelancers looking to simplify payroll, a paycheck creator is the perfect solution for managing extra earnings with ease.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?