Understanding the Factors Behind Silver Coin Prices

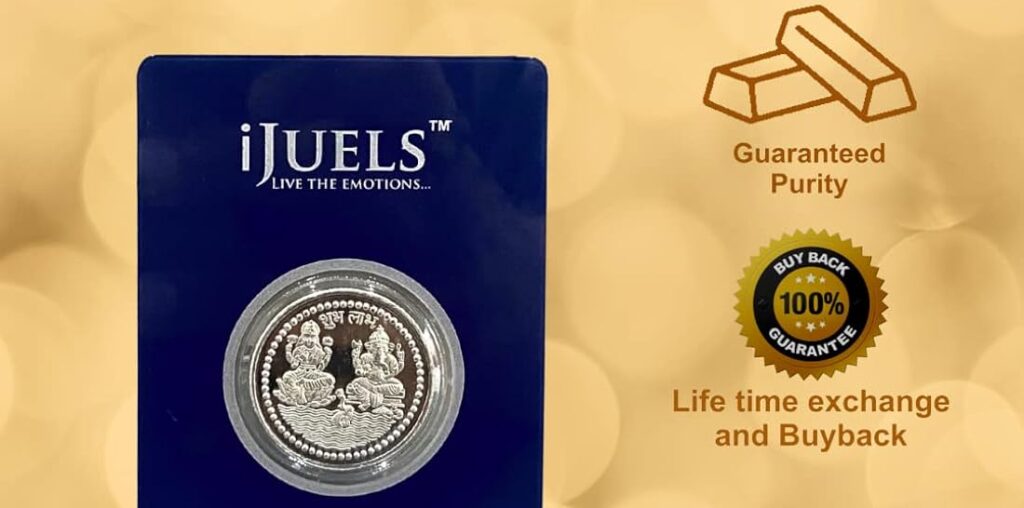

Silver coins have long been a popular choice for both collectors and investors. Their beauty, history, and intrinsic value make them an appealing addition to any collection or investment portfolio. However, the silver coin price can vary significantly based on a range of factors. At Ijuels, we understand the complexities of the silver market and strive to provide our customers with the best quality coins at competitive prices.

The Basics of Silver Coin Pricing

Before delving into the factors that influence silver coin prices, it is essential to understand what these prices encompass. The silver coin price typically reflects the current market value of silver, along with additional premiums based on coin characteristics such as rarity, historical significance, and condition.

When you consider purchasing silver coins, you are not just buying a metal; you are investing in a piece of art, history, and a potential financial asset. Prices can fluctuate daily based on market conditions, making it essential for buyers to stay informed.

Key Factors Influencing Silver Coin Prices

- Market Demand and Supply

The laws of supply and demand are the primary drivers of the silver coin price. When demand for silver coins increases, prices tend to rise. Factors contributing to increased demand can include market trends, investor interest in precious metals as a hedge against inflation, and changes in consumer behavior. Conversely, when the supply of silver exceeds demand, prices may decrease. Tracking these market dynamics can help investors make informed decisions. - Purity of Silver

The purity of silver in a coin significantly impacts its price. Most silver coins are made from either .999 (99.9% pure) or .925 (92.5% pure) silver. Coins with a higher silver content usually command a higher price due to their intrinsic value. At Ijuels, we ensure our silver coins are of the highest purity, allowing our customers to invest confidently. - Rarity and Collectibility

The rarity of a silver coin is another crucial factor in determining its price. Limited edition coins or those with historical significance often have higher price tags. Collectors are typically willing to pay a premium for unique pieces, making collectibility a key aspect to consider when evaluating the silver coin price. At Ijuels, we offer a range of coins that cater to collectors, from common varieties to rare finds. - Economic Conditions

Economic factors play a vital role in influencing silver prices. For example, during times of economic uncertainty or inflation, investors often flock to silver as a safe haven, leading to increased demand and higher prices. Factors such as currency strength, interest rates, and geopolitical tensions can also affect the silver market. Staying informed about these economic indicators can provide valuable insights into potential price movements. - Market Sentiment and Trends

The sentiment surrounding the silver market can significantly influence prices. Positive news regarding silver mining, advancements in technology related to silver, or changes in government policies can create bullish sentiment, driving prices higher. Conversely, negative news or trends may lead to a decline in prices. At Ijuels, we keep a close eye on market sentiment to provide our customers with timely information about their investments.

Investing in Silver Coins

Investing in silver coins can be a rewarding experience, but it is crucial to approach it with knowledge and care. By understanding the factors influencing the silver coin price, potential investors can make informed choices.

- Research and Education

Knowledge is power in the world of investments. Before purchasing silver coins, it is essential to research current market trends, historical prices, and the specific characteristics of the coins you are interested in. This research will help you make informed decisions and potentially secure better deals. - Diverse Portfolio

Diversification is a crucial strategy in investing. Instead of putting all your funds into a single type of silver coin, consider building a diverse portfolio that includes various coins with different characteristics. This strategy can help mitigate risks and increase your chances of overall gains. - Buy from Reputable Sources

Purchasing silver coins from reputable dealers is vital to ensure you are receiving genuine products. At Ijuels, we pride ourselves on our integrity and commitment to quality. Our silver coins are sourced from trusted suppliers, providing our customers with peace of mind. - Monitor Market Trends

Staying updated on market trends and news can help you make timely investment decisions. By keeping an eye on the factors that influence silver coin prices, such as economic indicators and market sentiment, you can identify opportunities for buying or selling coins at favorable prices.

Conclusion

Understanding the factors that influence silver coin prices is essential for anyone looking to invest in silver coins. From market demand and supply dynamics to the purity and collectibility of individual coins, several elements play a role in determining prices. By educating yourself and making informed decisions, you can navigate the silver market with confidence. At Ijuels, we offer a stunning selection of high-quality silver coins that cater to both collectors and investors. Whether you are looking to enhance your collection or make a strategic investment, we are here to help you every step of the way. Discover our collection today and join the world of silver coin collecting and investing!