These accounts are referred to as temporary because their balances are reset to zero at the end of each cycle. This is crucial to provide accurate financial statements and ensure that the company’s managing contacts in xero accounts accurately reflect its financial position. After preparing the unadjusted trial balance, the next step involves making adjustments to account for accruals, deferrals, and depreciation.

Identify and analyze transactions during the accounting period.

- Our team is ready to learn about your business and guide you to the right solution.

- Most businesses are going to have numerous transactions each accounting period.

- Searching for and fixing these errors is called making correcting entries.

- A purchase order (PO) is an extension of a purchase requisition (PR).

HighRadius’s solutions not only optimize the accounting cycle but also ensure a faster, error-free close. Once you close the accounts, you’re ready to restart the accounting cycle for the next fiscal year. The framework offers bookkeepers and accountants the chance to verify the recorded transactions for uniformity and accuracy, both of which are critical compliance parameters. After a stint in equity research, he switched to writing for B2B brands full-time. Arjun has since written for investment firms, consultants, and SaaS brands in the Accounting and Finance space. Business transactions identified are then analyzed to determine the accounts affected and the amounts to be recorded.

Transaction recording in journal

Companies can modify the accounting cycle’s steps to fit their business models and accounting procedures. One of the major modifications you can make is the type of accounting method used. Organizations may follow cash accounting or accrual accounting or choose between single-entry and double-entry accounting. After determining the accounts involved, the next step is to journalize the transaction in a journal book. This book is also called the book of original entry because this is the first record where transactions are entered.

What is transactional accounting?

During the month of January, Haram’s Company process the following transactions. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

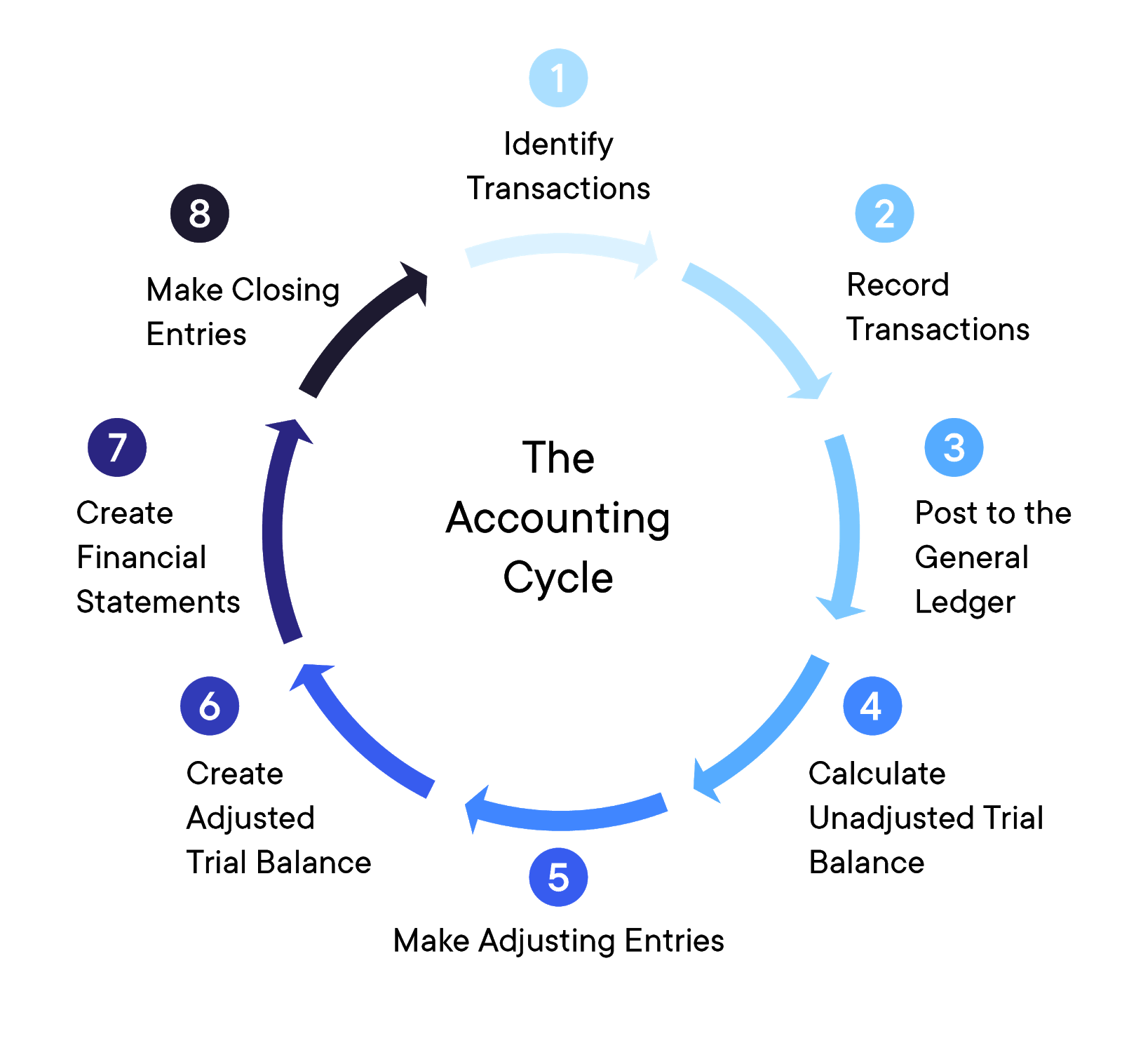

Each step in the accounting cycle contributes to the accuracy, organization, and usefulness of these records. The accounting cycle is an essential process that businesses and accountants use to effectively manage a company’s financial records. It comprises a series of eight steps that deal with the recording, analysis, and reporting of financial transactions. These steps ensure that a company’s financial statements are accurate, up-to-date, and in compliance with regulatory requirements. The debits and credits from each journal entry ultimately combine within the general ledger, providing an overview of all financial transactions in the company.

Once transactions are recorded in journals, they are also posted to the general ledger. A general ledger is a critical aspect of accounting as it serves as a master record of all financial transactions. One of the accounting cycle’s main objectives is to ensure all the finances during the accounting period are recorded and reflected in the statements accurately. Stakeholders, including management, the Board of Directors, lenders, shareholders, and creditors, can analyze the financial statement results for the accounting cycle period. The first step of the accounting cycle is to analyze each transaction as it occurs in the business.

It must also be approved by an authorized person at each specific price range before sending it to the supplier to place the order. This article introduces a document that many people are familiar with but might not fully understand how to utilize. We’ll explore what a purchase order (PO) actually is, when it should be used, and how it should be routed within the procurement cycle to ensure effective control. Tax adjustments help you account for things like depreciation and other tax deductions. For example, you may have paid big money for a new piece of equipment, but you’d be able to write off part of the cost this year.

For example, when a customer pays $500 to start an annual subscription, it marks the beginning of the accounting cycle. Accruals have to do with revenues you weren’t immediately paid for and expenses you didn’t immediately pay. Think of the unpaid bill that you sent to the customer two weeks ago, or the invoice from your supplier you haven’t sent money for. Certified Public Accountant (CPA) Thailand with experience as an external auditor for listed companies who aspires to make accounting easy and accessible for everyone.

Accounting software helps automate several steps in the accounting cycle. Depending on the solution, bookkeepers, certified public accountants and business owners don’t have to intervene or perform some accounting cycle tasks manually. Instead, they can set up workflows in their program of choice to complete various parts of the process. Another perk of using accounting software is the reporting functionality that allows you to generate essential reports and analyze your company’s financial health easily.